How Can I Set my Own Risk Management System?

BEFORE USING THIS MODULE PLEASE TEST IT USING VOLFIX SIMULATED ACCOUNTS.

How can I benefit from the Risk Management System

Due to the Risk Management system you can set your own risk management parameters to automatically control risks. I.e. you can set your Daily Loss Limit (can be set for any traded Symbol individually). You can also control the number of losing trades for every instrument you trade. In addition, you can set a temporary account block if something goes wrong and apply automatic protection for that. You can have your open positions be closed automatically if one of your risk parameters is triggered.

Always use Stop orders.

The auto close function DOES NOT guarantee an exact position closing, as it is not possible to close a position at a specific price. The position is closed with a market order. For precise loss fixation, use stop orders.

Please familiarize yourself with the information below.

How does Risk Management System work?

When you set the desired risk parameters and hit the Apply button, your Risk Management System is activated. It is a server-side system, so you always control your risks even if your Internet connection drops. If one of the risk parameters is broken, your account will be blocked in the trading platform for the current trading session.

You can use a password to remove the block, however, if you set the cool-off period, the block can be removed after this period expires. If you forget your password, you can only recover it via Volfix support.

How do I open the Risk Management window?

In Market Watch choose component->position control and select account field and then click on the account you need, after that use the risk management button appeared.

How do I set my Risk Management System?

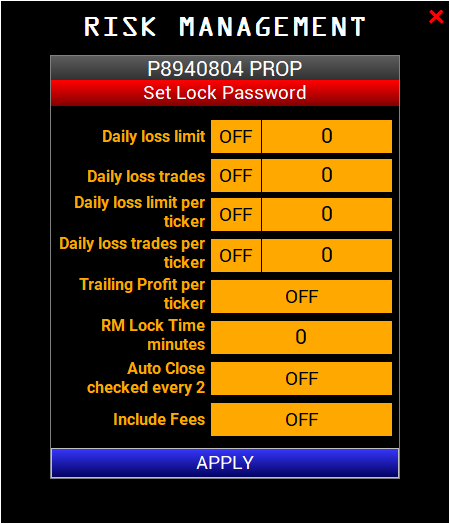

Set Lock Password - before setting other parameters, set your password. This password lets you unblock the account if one of the risk parameters has been hit. This password can only be recovered with VolFix.Net support team, so be careful when you set it

Auto Close - is a very important function. Without it enabled the positions will not be closed!

It automatically closes losing trades (winning trades are not closed) when the personal risk management system is triggered. When Auto Close is ON, all losing trades will be closed and the trader will not be able to open trades anymore, since the account will be blocked. However, the winning trades will still be open until the trader chooses to close them.

If Auto Close is OFF, the losing trades will not be closed and the trader will not be able to open new trades, since the account will be blocked, but the trader will be able to manually close both losing trades and winning trades.

ATTENTION! The auto close function DOES NOT guarantee an exact position closing, as it is not possible to close a position at a specific price. The position is closed with a market order. For precise loss fixation, use stop orders.

Daily loss limit- controls your total daily loss limit for the account. If you hit it, your account will be blocked until the end of the current trading session

Daily loss limit per ticker - let's say you are trading two symbols, CL and GC. Now let's say you set this parameter $1000. At the moment, you are having a loss of $500 for CL and $500 for GC. Your trading won't be blocked until you will reach a $1000 loss for either CL or GC.

Daily loss trades per ticker - max number of losing trades for any traded symbol. This works the same way as the previous parameter. Let's say you set 5 here and you trade CL and GC. Even if you reach 2 losing trades for CL and 4 for GC, your trading won't be blocked until you reach 5 losing trades for either of those symbols.

Trailing Profit per ticker - This function protects realized profit separately for each instrument. It uses the value of Daily Loss per ticker. If the function "Auto Close" is active, then in case we lose $300 of realized profit, all positions will be closed automatically, and the opening of new positions will be blocked. If the "Auto Close" function is disabled, positions will not be closed automatically, but we can't open new ones till the end of the session.

For instance, in this case, if we have reached a realized profit of $500 and we lose $300 on that amount, the account will be blocked. In other words, the value shown in the "Daily loss per ticker" field is used. Or, in case of a realized profit of $200, the account will be blocked if we reach a loss of $100 afterward, i.e., $200 minus $300 equals 100$ of loss.

RM Lock Time, minutes - cool-off period in minutes when your account cannot be unblocked even with your password. After the cool-off period, you can use your password to unblock your account.

Include Fees - choose whether to include account commissions in your personal risk management system. If this parameter is enabled (ON), the account commissions will be included when calculating risks. If this parameter is turned off (OFF), commissions will not be taken into account.

Additional features (mobile app and tradeout by time order)

You can set a certain time to flatten your positions with a tradeout by time order. Get more information about that here.

You can also use a mobile app to control all your account positions. Here's more information about that.

Customer support service by UserEcho