Max Trailing Drawdown

What does Max Trailing Drawdown do?

The Max Trailing Drawdown sets the minimum account balance that should not be reached or below which the account

balance should not fall. The minimum account balance can change during the clearing session after market close.

The Max Trailing Drawdown is checked for violation in real-time. Recalculated at EOD (end of day).

Where can I see the minimum account balance?

The minimum account balance is displayed in the "Do not allow your Account Balance to go below " field in the LMI Trade Report module.

How often is it checked whether the account balance has reached the minimum balance?

For all accounts except Practice session this check is done in real time. For the Practice session accounts, the check is done at the moment of market close.

How and when is the minimum account balance recalculated?

In the LMI Trade Report module, there is a field labeled "High:", which indicates the maximum

account balance at market close before the clearing session for the entire duration of the account.

If the "High:" field is updated, the minimum account balance will be recalculated as follows:

"High" field value - Max Trailing Drawdown = Minimum account balance.

Please note: on some holidays trading results for two days will be counted as 1 trading

day.

What is the increase limit of the minimum account balance?

The minimum account balance can be recalculated up to the initial account balance*, after which it is no longer

recalculated.

* An

important note for Funded Session traders.

| Account size | $10,000 | $30,000 | $50,000 | $100,000 | $150,000 | $300,000 |

| When Max Trailing Drawdown stops moving | $10,500 and above | $31,500 and above | $52,500 and above | $103,000 and above | $155,000 and above | $307,500 and above |

What happens if the account balance falls below the minimum account balance?

If the account balance falls below the specified amount, it will be a violation of trading rules and the account will be blocked.

How to remove the account block?

To unlock an account, you need to use a separate paid feature called "Account Restart". After using

this feature, your account will be like new, but the account expiration date and the stage of the account's

evaluation program will remain unchanged.

Information about Account Restart for Practice, Qualifying and Qualifying Pro sessions.

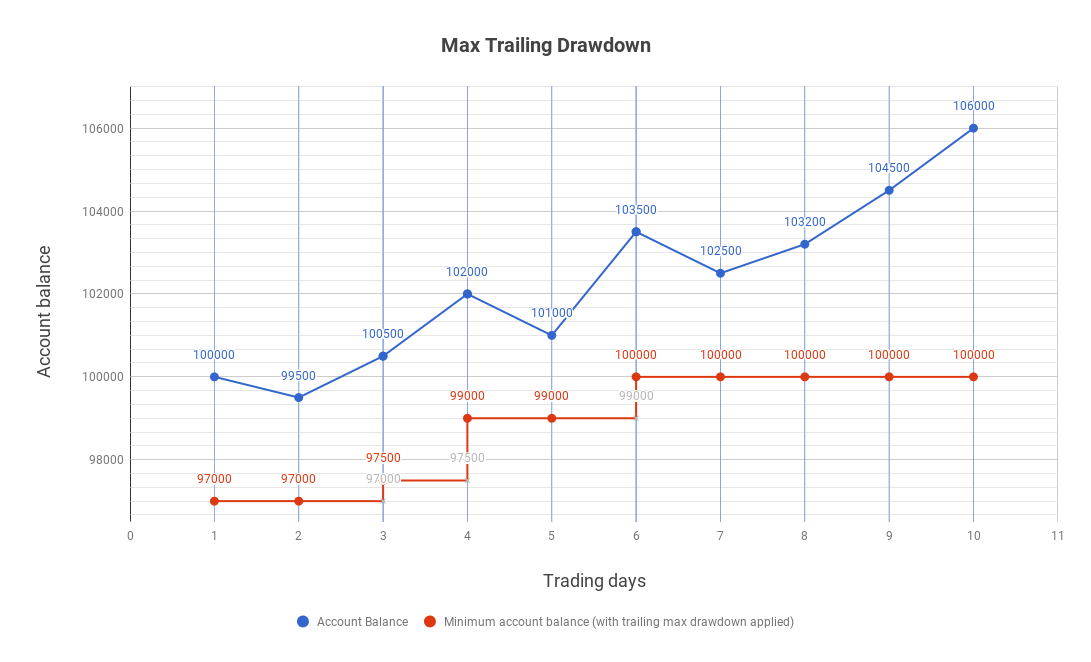

An example of Max Trailing Drawdown calculations

The chart shows the values of the minimum possible account balance (red line) and account balance (blue

chart) at the time of the trading day open. Therefore, all profits and losses this trader received affected the

minimum possible account balance and for the current and the following day.

Now let's go into detail for each trading day you can see on the image above.

trading day 1: since the trading has not yet begun, we will calculate the initial account balance before opening the market: $100,000 (initial account balance).

At the end of day 1, the trader had a $ 500 loss. This is reflected on the next day's balance which is calculated once the previous day's market was closed.

trading day 2: The starting account balance for day 2 is: $ 100,000 (initial account balance) - (minus) $ 500 (loss on the previous trading day) = $ 99,500.

At this point, the account balance remains at $99,500.

A profit of $1000 was generated for this trading day.

trading day 3: Because of the previous day's $ 1,000 profit, the account balance has gone up after the day 2 close. The account balance can be calculated as follows $ 99,500 (account balance of the previous day) + $ 1,000 (profit for the second trading day) = $ 100,500.

With this new account balance, we can proceed with the next trading day.

An income of $ 1,500 was generated for this trading day.

trading day 4: Due to the previous day's profit of $ 1,500, the account balance updated after the market closed on the third day. The starting account balance for day 4 is $ 100,500 (account balance of the previous day) + $ 1,500 (income for the third trading day) = $ 102,000.

Thus, the new account balance at the beginning of trading day 4 is $102,000.

For this trading day, a loss of $ 1,000 was received.

trading day 5: on the fourth trading day, a loss of $ 1,000 was received, that is, the account balance before trading is: $ 102,000 (account balance of the previous day) - ( $ 1,000 (loss for the fourth trading day) = $ 101,000.

The value of the account balance remains at $101,000.

A profit of $ 2,500 was generated for this trading

day.

trading day 6: on the fifth trading day, A profit of $ 2,500 was received, due to which

the account balance updated after the market closed on the fifth day. The starting account balance for day 6

is: $ 101,000 (account balance of the previous day) + (plus) $ 2,500 (income for the fifth trading day) = $

103,500.

Since there's a new account balance, we can proceed with the next trading day.

Now when we calculate the new account balance, we get: $ 101,000 (account balance of the previous day) + $ 2,500 = $ 103,500.

The rest of the trading days are not calculated since the minimum account balance no longer changes.

Customer support service by UserEcho